In 2008, excessive risk-taking on the part of numerous large banks combined with a housing bubble that U.S. banking groups treated as though it’d never stop expanding. This created a recipe for financial disaster: That housing bubble burst, plunging the world into a complete financial crisis. The U.S. government began bailing out banks to salvage an economy that was quickly sliding into a massive recession.

JPMorgan Chase was one bank that received a bailout in 2008 following sales of risky mortgage-backed securities prior to the financial crisis. However, it was just one of many banks to take part in these practices, and the treasury department saved additional banks with a $700 billion bailout following the financial crash. Learn more about why JPMorgan Chase and other institutions received enough financial assistance to prevent them from total collapse.

What Led to the Bailout?

To understand why banks were bailed out in the first place, it’s also important to understand the historical context and economic climate of the world when the bailouts took place. Starting in the late 1990s, banks began extending expensive mortgages to people who didn’t have good credit profiles — mortgages that the buyers couldn’t really afford. This inflated housing prices around the country, causing an economic bubble in which inflation happened at a very fast rate in a short period of time. Housing prices continued to increase each year into the 2000s. To respond to what appeared to be increased demand for housing, developers and construction companies began building many more new homes around the country.

While this housing bubble was forming, banks began investing in these subprime mortgage loans — the risky loans that were extended to people with poor credit ratings. Smaller banks began selling people’s mortgages and the rights to future interest payments to larger banks in bundles that contained the loans for many homes. The larger investment banks began investing portions of this bundled money in risky ways under the assumption that people would continue paying their mortgages and the payments would keep rolling in, which theoretically lowered the risk of the investments.

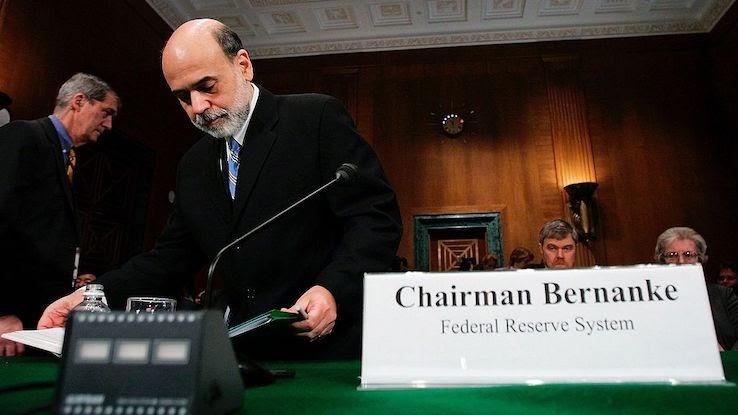

This scheme came crashing down when the Federal Reserve elected to raise interest rates nationally. Suddenly, many people could no longer afford their mortgage payments, and many elected to go into foreclosure and let the banks take their homes back. The banks began trying to sell these homes, but, because of all the recent new construction that had flooded the market with houses, supply far outpaced demand. This drove down the prices of properties even further. With people’s mortgage payments no longer coming in, the large banks that had been gambling with investments found themselves without any money to operate — and it was largely due to their own misconduct.

The U.S. Government Provides Relief — but Not Much

In October of 2008, Congress passed the Emergency Economic Stabilization Act of 2008 and George Bush signed it into law. The goal of this legislation was to buy up many of the massive debts the investment banks had incurred during the beginning of the crisis and to invest money into large banks to ensure their continued operation.

The reason for this? These banks had simply grown too large, and allowing any sort of failure or closure to happen would’ve had disastrous consequences. Many of the banks would have gone bankrupt, resulting in a cascade effect of related businesses going bankrupt until it reached small, local businesses — many of which were already suffering due to the new recession. Millions of people would’ve lost their health insurance during a time in history when getting coverage was already near-impossible for some. The potential bankruptcies would’ve resulted in unemployment levels far worse than those the country was already enduring at the time. The collapse of such large financial institutions would have spun the world into a global depression. Thus, the banks were bailed out in order to prevent these financial and economic catastrophes from taking place.

In 2008, JPMorgan Chase received a $25 billion bailout from the Federal Reserve. That same year, a wholly owned JPMorgan Chase subsidiary merged with Bear Sterns, and JPMorgan also acquired Washington Mutual. JPMorgan Chase was one of the original nine banks in the U.S. to receive money from the Treasury’s Capital Purchase Program. JPMorgan repaid its funds in full in June 2009.

JPMorgan Chase Faces a $13 Billion Settlement for Its Role in the Crisis

JPMorgan Chase did face some consequences following the recession and bailout due to its alleged role in causing the near-collapse of the banking system. In late 2013, JPMorgan agreed to pay a $13 billion settlement for selling mortgage-backed securities before the financial crisis. JPMorgan, along with the Bear Stearns and Washington Mutual firms it purchased that year, had sold risky mortgage securities in the midst of the housing bubble and made significant misrepresentations to the public about these investments. The securities eventually failed in large numbers, and JPMorgan’s actions were deemed to have had a significant role in worsening the 2008 financial crisis.

As part of the settlement, JPMorgan Chase was required to provide relief to struggling homeowners and potential buyers. The $13 billion settlement included a $1.5 billion repayment in consumer aid to lower loan payments for underwater borrowers, along with repayments of varying amounts to affected states that included California, New York, Massachusetts, Delaware and Illinois.