The COVID-19 pandemic has affected everyone across the globe in innumerable ways and in every facet of our lives — socially, mentally, economically, personally — and it continues to impact our day-to-day living in untold ways. To help mitigate some of the devastating effects of this enduring event, the U.S. government created a safety net of various relief programs and mandates that involved providing financial assistance to Americans in the form of everything from rental eviction protections to economic stimulus payments. However, many of these programs are reaching the ends of their extensions and eligibility periods and are slated to end in the coming weeks and months.

If you’ve been utilizing any of the U.S.’s pandemic relief programs, you’ll likely find yourself wondering what the future may hold — and how you might need to adapt. To help, we’ve assembled a list of some of the most commonly utilized federal assistance programs and included details about what they were designed to accomplish and what’s happening to them as they wind down. You’ll also learn about a few options to consider if the expiration dates aren’t extended.

Eviction Protections for Renters Were Recently Revised

Since nearly the beginning of the pandemic, protections have been in place to prevent renters from being evicted from their homes during the largest public health crisis in recent history. The Centers for Disease Control and Prevention (CDC) implemented an eviction moratorium in 2020 that was ultimately extended until July 31 of this year.

This measure was initially intended to last through the end of the pandemic or until the country reached herd immunity — neither of which happened — and the moratorium did officially end in July. Despite this brief expiration of the moratorium, the CDC enacted an emergency reinstatement of the order, which is now set to last through October 3, 2021, unless the spread of variants necessitates further extensions.

If you’re a renter, particularly one who could face eviction after the moratorium expires, it helps to know you can access resources to protect yourself. First, keep in mind that state and local governments can choose to extend their specific moratoriums on evictions; your state may still offer you protections even after the federally mandated period ends. For example, New York had already extended the date of its moratorium until the end of August before the CDC’s October directive was implemented.

The housing research organization Eviction Lab has also put together a list of state-led initiatives you can access to learn more about what options and recourse are available to you if you rent. This is designed to limit potential economic hardship stemming from a cascade of evictions that may take place during the coming months.

If you’re at risk of eviction, you may have the right to legal counsel; as an example, Washington State recently signed into law a bill that provides free lawyers to tenants who meet certain income guidelines. The Legal Services Corporation (LSC) is an independent nonprofit organization that provides financial support for civil legal aid for low-income families. Even if pandemic-related eviction protections are removed, you can also find state-specific rental assistance via the Department of the Treasury. Even if you’re not sure you’ll need these resources, it helps to get familiar with them just in case — you might also know someone who can really benefit from them.

The Student Loan Payment Pause Ends in 2 Months

For over a year, college graduates who participate in federal student loan programs have been given some breathing room. The Department of Education implemented a student loan payment pause during March of 2020, and this was extended when President Biden took office.

Tens of millions of learners took advantage of the administrative forbearance, which included a halt on student loan collections efforts. Currently, loan repayments are scheduled to restart by September 30 for those who chose to pause paying on their student loans. Some advocates believe more time is needed and are lobbying to extend the administrative forbearance into 2022.

If you put your student loans into forbearance during the pandemic, now is the time to visit the Department of Education’s National Student Loan Data System (NSLDS) to determine your loan servicer. Contact the loan servicer to discuss options like lowering your payments. They can help you determine if you’re eligible for another form of assistance or if you have access to different payment options based on your current income and financial status.

With fewer than two months left before the payment pause expires, it’s important to start making new payment arrangements to prevent your student loans from going into collections if you anticipate being unable to resume your previous payments.

Extended Unemployment Insurance Has a September Deadline

Some of the most important assistance measures enacted in response to the COVID-19 pandemic are the various pieces of financial relief legislation Congress has passed. Expanded unemployment insurance eligibility, extended benefits and increased payment amounts helped states limit economic hardship when most businesses had to shut down.

Federal support for those enhanced unemployment insurance benefits is set to end on September 6. Many unemployed people who’ve relied on the extra funds provided by the federal government to pay rent could experience a higher risk of eviction when eviction protections are eliminated.

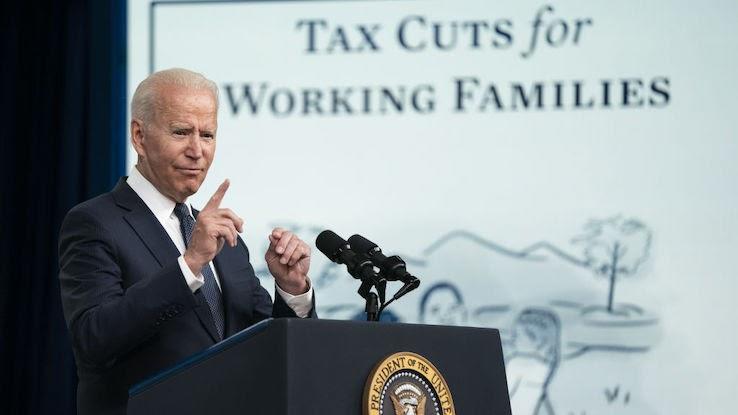

The extra $300 supplemental federal payments may be ending in September, but various states have already announced plans to halt their own pandemic-related unemployment programs before that. In remarks delivered at the beginning of June 2021, President Biden noted that it “makes sense it expires in 90 days” in reference to unemployment assistance because unemployment filings have slowed and hundreds of thousands of jobs have been created.

It’s important to note that the increase in coronavirus cases across the country due to the spread of the Delta variant in particular may impact employment rates. Unless changes are enacted to the benefits expiration in response to this, however, you can find out whether you’re eligible for extended benefits by checking your state’s unemployment website.

You Can Easily Modify or Obtain Health Insurance — but Act Quickly

A few deadlines are also approaching that you’ll want to be aware of if you currently need health insurance (or recently lost your coverage). The federal health insurance clearinghouse Healthcare.gov is offering a special enrollment period that’s open through August 15, 2021, during which you can select and sign up for an insurance plan.

If you currently have a healthcare plan that you’ve purchased through the federal government’s Health Insurance Marketplace on Healthcare.gov, you’re eligible to switch to a different plan before the August 15 deadline. Changes in eligibility requirements also mean “More people than ever before will qualify for help paying for health coverage, even those who weren’t eligible in the past,” according to Healthcare.gov. The American Rescue Plan Act of 2021 included provisions that lowered costs on health insurance plans via a tax credit. To find out if you’re eligible for the credit’s cost reduction, you’ll need to apply for Marketplace coverage.

In addition, the Consolidated Omnibus Budget Reconciliation Act (COBRA) may pay your entire health insurance premium if you lost your job or experienced reduced hours due to the pandemic. COBRA allows you to continue health insurance coverage from your job even after you no longer work there. Normally, Americans are expected to pay the entire premium amount for COBRA coverage themselves. But, a COBRA subsidy is currently slated to cover these premium costs until September 30.

You Have Home Loan Options, Even After Mortgage Forbearance

If you have a federally backed mortgage and have been taking advantage of the temporary mortgage-payment forbearance that’s been in place since March of 2020, your payments may be restarting soon. This program has an 18-month maximum term with an end date that was recently extended to September 30.

If you began a mortgage forbearance in March of 2020, you’ll want to start making plans to begin paying your mortgage again once the term expires. Contact your loan servicer to discuss options to catch up on payments or determine if you can move them to the back of your mortgage to settle the payments when you pay off your loan or sell your home. If needed, you can also start a new forbearance that’ll last through the end of September if you haven’t yet suspended your payments.

If your loan is backed by Fannie Mae or Freddie Mac, you can also ask about loan modification — there are numerous options available that can help. You may be able to negotiate a new repayment plan, extend the term of your mortgage or refinance to a lower rate, among other options.